HOW DOES THIS THING WORK?

Have you noticed that there seems to be a bunch of new Outsourced CFOs about? This is a great thing, I think there needs to be a lot more of us.

That’s because there is a big gap between the sort of advice businesses can get once a year from their tax accountants and from someone that has worked inside businesses, businesses like yours, helping to run them.

What your tax accountant does have is visibility across a number of businesses, and that’s very valuable because most accountants that work inside a company full-time don’t have that, they can get caught up with the day-to-day and get a bit siloed.The rise of Outsourced CFOs bridges this gap, you get the best of both. They should have seen lots of businesses like yours, they should know what works, and what doesn’t work.The reason we are happy about the recent increase in Outsourced CFOs is because it’s been hard sometimes to explain to people what we do. We are accountants after all, not marketers, and Outsourced CFOs is a fairly new concept that a lot of people don’t get unless they’ve seen it work.There is a term in economics called “economies of agglomeration” which explains why you see a bunch of restaurants in the same strip sometimes, in aggregate more people go there to eat because they know they will be able to find something that suits them. As tax and bookkeeping become even more automated I think we are going to see many more Outsourced CFOs helping businesses and more people understanding what benefits they can bring.So, what is it that an Outsourced CFO should do well?

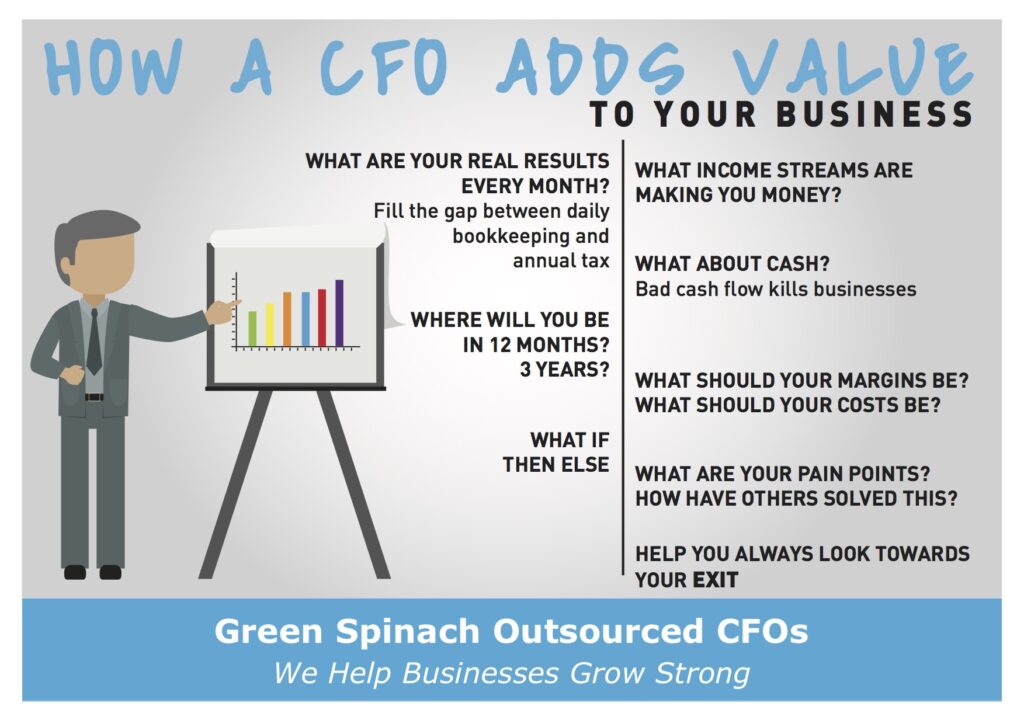

1) Where are you really each month? Where are you headed?I think it takes a lot of skill and experience to provide a clear picture of where a business is and what it’s trends are. Reports need to show changes in performance at least monthly, not just a set of annual tax accounts. And it can’t just be a set of cash accounts done by a bookkeeper. Proper, clear, and succinct, accrual management accounts are extremely powerful; once you experience what they can show you won’t ever put up with anything less. Outsourced CFO’s don’t actually have to crunch these numbers for you, the real value is getting them to help whoever does the reports to do them in a way that can help you most. Or, help you find someone that can do it for a reasonable cost. And then to make sure that the reports stay relevant by keeping a watching brief over the process. In our experience, it’s a rare business that has monthly management accounts that accurately reflect where they are from month to month. We firmly believe there is a high correlation between accurate monthly management accounts and success. 2) Now you know where you are, where do you want to end up?Call it strategy if you will but we think that most business people know what their strategy is. Do a search on LinkedIn and you can find plenty of strategy consultants, and they definitely have their place, but we believe the best bang-for-buck from your Outsourced CFO comes more from tactics. The art of connecting short-term actions to long-term goals. And then making sure operational and reporting systems support those initiatives so you can keep on track. Basically, making sure your business is doing the right things, and those things are in fact being done. 3) What have other people done in this situation?There is no substitute for experience. Whenever you engage an advisor, make sure they have done it with their own bare hands on the shop floor before, and more than once. We’ve been asked by quite a few accountants about what we think is important, about the best ways to help clients above and beyond just ding BAS and tax returns. Our response is always the same, have a genuine interest in your client’s business and always be willing to listen and learn from them. It’s not about handing out sage technical advice from behind a desk, it’s about working togeather with the business, helping them to use efficient tools and tactics to flourish. And, hopefully, to have some fun along the way. 4) What the margins and costs should beThe easy way to tell if you are on track is to see how your margins and cost ratios match other businesses like yours. Your Outsourced CFO should be able to tell you what these are, and to help you plan improvements. 5) If, then, elseA good Outsourced CFO can prepare a simple model of your business that you can use, together, to help decide what to do about all those things that stress you out; when to take on new staff, how fast can you grow, how much to spend on marketing, how much cash can you take out in salary and dividends. 6) The exit (where you want to end up)Selling a business can be a daunting thing. You’ll need a good business broker, like you need a good real estate agent to sell your house. But also make sure you have a good wingman that can help you with all the financial aspects a sale brings up – from help with clear and elegant management accounts and business plans to lining everything up for due diligence.I would recommend that you regularly review these six things to make sure you are on track.

We typically go into a new client’s business and do an extensive evaluation of key performance and processes. This process gives you critical information, stuff that’s difficult for most businesses to ever find out. And without it’s hard to take a business to the next level.

In the past it has sometimes been a little difficult for us to articulate outcomes to potential clients, we could see it but, its usually the sort of thing you have to see for yourself. And sometimes, when we did start working togeather, clients would be unsure about what to do first – from the long list of things we might do togeather. Perhaps try to do too much and get bill shock. Sometimes too, clients might not be a good fit for us, but it was hard for us to know that in the beginning.What we do now, what has changed everything for our clients, and for us, is our fixed-price 2-Week CFO Program.We now show potential clients what their financial model and diagnostic report will look like in advance, and clearly explain what you should expect. At the end of the 2-Week Program, you can decide if you want to use us for ongoing services. We get to make recommendations based on solid data and investigations. And the cool thing is, leaving aside that it’s great value in itself, we can recommend any ongoing services with real clarity.The 2-Week Program starts with us spending time with you to gather information from a number of sources, then taking time to look at different aspects of the business.Some of the big picture things we look at are: 1. cash flow

2. margins

3. reporting

4. systems

5. data & processes

6. profitability

7. people

8. risks

Richard has very strong systems and process skills, Thomas more of the tactics – the who/what/why stuff. So, the two of us analyse your business in depth, and then prepare a written 40 odd page diagnostic report. It contains the results and our recommendations. Then we sit down with the you to go through it all in detail.

It’s designed to help you get an outside view across a broad range of important items; and whilst we acknowledge that we look at problems primarily from a CFO’s perspective, we think that’s not such a bad thing sometimes. It’s packed full of useful stuff, and our clients that have been through the 2 week program have all loved it.Some of this diagnostic report deals with housekeeping items, some with strategy, but most of it is concerned with on-the-ground tactics learned from years of working as CFO’s inside different types of businesses.We often recommend better management reporting, but also, the equally important, regular time put aside each month to review and interpret the results. Data and analysis that can better facilitate sensible adjustments to your operations as circumstances change.This might seem like someone that’s good with a hammer thinking every problem is a nail, but we have been around long enough to see good reporting as a major contributor to many a success story. And the opposite, the absence of control, all too often associated with years of bumping along the bottom. It’s important to note that good reporting does not mean complex reporting. It should be elegant. Elegant as in: “pleasingly ingenious and simple”. As complex as it needs to be and no more. And whilst this diagnostic report is not just about reporting, it’s just one aspect of the many sections. Still, we are unashamedly strong believers in reporting. In establishing robust and simple reporting regimes and then sticking to them for years – so that it becomes part of a shared language of the organisation. In our view, there is nothing worse than needlessly chopping and changing. The first step in the 2-Week Program is us preparing a concise financial model of the business. It’s information that’s required if we are going to make meaningful recommendations. All part of not giving advice before we have data and have asked some solid questions. We’ve all seen the alternative.The model gives us a powerful tool to see what income streams are making money now, and what they might make in the future if changes were, or were not, made.

It allows us to see when the business can employ people, as well as important KPI’s like cost of client acquisition and long-term client value. Plus we get to know the business inside-out, and that means we can be even more helpful. For example, we like to use a model to determine the best way to format management your reports and budgets.

Ongoing, it is a fairly simple matter for us to update the model when circumstances change, allowing us to give quick answers to questions down the track. We recommend you do it every quarter.

At the end of the 2-Week Program, we might recommend a number of recurring services. Ok, we always do.. but, at that point, we can prove the value.

Firstly, we do monthly, weekly if required, operational reports for clients. Particularly professional services firms, and especially those that also package services and/or have recurring revenue. Or want to start doing that and not lose control of things.

We usually recommend our monthly reports in our diagnostic, as an outsourced service. And they are very cool, even if we do say so ourselves. Ongoing it is usually just a couple of hours a month for us when it would take most people days to do what we do. Plus, with respect, they would have to know why and how to do it.With this reporting service in place, most businesses up to 50 people only need an outsourced bookkeeping/BAS/tax return provider instead of full-time accounts staff (and we know people that do this well for a reasonable cost). You have us for all the who/what/why/how stuff once a month, or as needed, something you don’t get from a 60K staff member, or even 100K. So then, there is usually no need for you to have an accounts person at all. Instead, you can have an all-purpose administration person. Perhaps doing a lot of sales support. This is a solution that is getting great results for our clients.

Another ongoing service we offer; a really valuable one, is having one of us go through the reports with you once a month. An important thing to make time for in most businesses.

Or you might want specialised, one-off, help with M&A, cash flow or systems. The important thing is that we all can make informed choices.

Does anyone on LinkedIn actually do any work? If you are the CEO of a company with about 50 to 200 staff you must be sick to death of “strategy consultants” harassing you.

As CFOs we are more tacticians that strategists, and would never dream of telling entrepreneurs, such as yourself, how to suck eggs.

Having said that, we do get to see inside a lot of businesses and can usually get a feel for a well-run business that is growing.

Head up, it’s usually always the businesses where the CEO is good at sales. But equally important are the healthy margins and cash you need to keep the machine running as it grows. That’s what we can help you with. Practical stuff.

Running a business is hard work, and there are always hundreds of things to do at any point in time. It’s almost impossible to keep on top of everything. We acknowledge that we look at problems primarily from a CFO’s perspective, but we think that’s not such a bad thing sometimes.

We help you nail down the important things, you already know the big stuff.

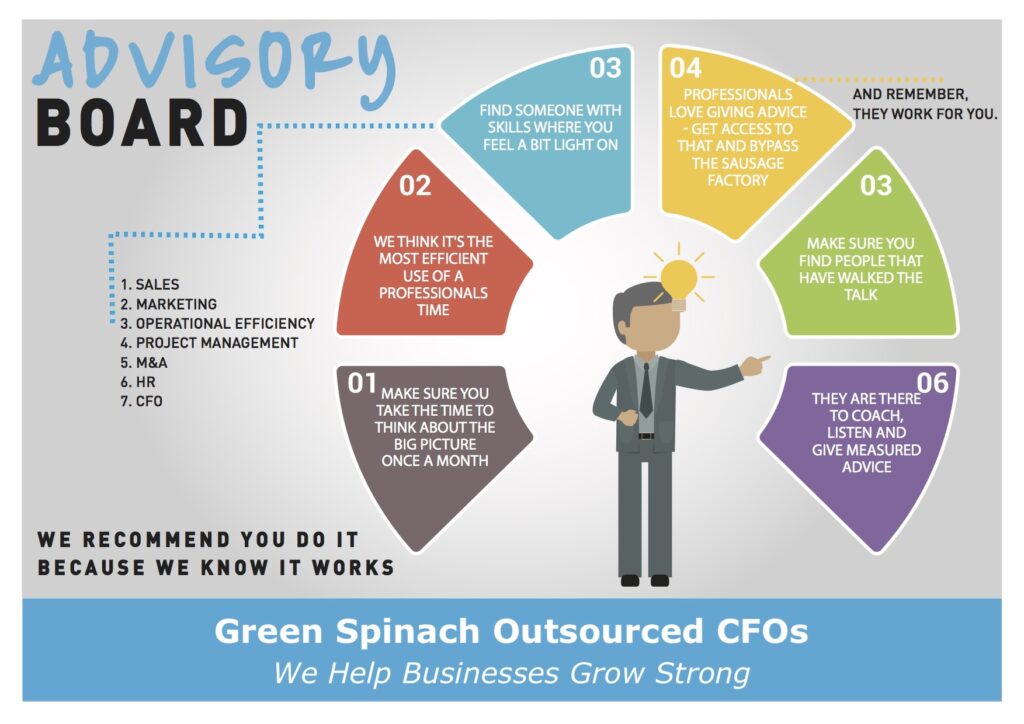

If you find yourself swamped by the day-to-day pressures of running your business and want to be more disciplined about setting time aside to consider the big issues, one of the best ways to make sure it happens regularly is to start an advisory board.

Holding an advisory board meeting every month will allow you to work through the challenges in your business with a few people who can support and guide you. Two hours a month can make a lot of difference to your business.I find this to be a very cost effective way of gaining access to professional advice. Find people with experience in your industry who complement and support your skills; people who have walked the talk and have a good bedside manner. Their role is to support, listen and advise. To let you know what worked for other people like you, and what didn’t.

Professional people love being on advisory boards because they get to feel useful. It’s what they love. Ask trusted people in your network to recommend people with particular skills; whatever you feel you need to bolster in the business.

This might be sales and marketing skills in the consulting industry, or project management and delivery skills in the software industry. Of course, I’m going to say finance, it’s what I do. I’m also going to advise you not to use your tax accountant. Whomever you choose, make sure they have a track record of doing what they purport to be experts in.

Not only will you get a lot out of the meetings and it will be a great help to your business, but I also think you might be surprised by how much you enjoy it if it’s done right. Just remember you don’t report to them.

Mm.. maybe not… but let’s chat about it. Never hurts. Mind, you have to be of a certain size for it all to make sense. Probably at least 1M turnover. Having said that, we have some big clients now that started out with us when they were very small but growing fast.

Regardless, it’s always good to hear what people are doing and perhaps we might know someone that can help you somehow. We genuinely like to support new businesses however we can.

The on-boarding process is a fixed cost. We set the price at an amount that sorts out who’s serious about getting stuff done, but less than it probably costs us for the hours we put in (we have trouble walking our own talk sometimes).

Ongoing, we will probably quote you a monthly charge for particular services or, sometimes, just an hourly rate with an estimate of time. That hourly rate is less than most accountants charge.

When Thomas started doing this 15 years ago not many people knew what an Outsourced CFO was, but we are becoming more widespread these days. Which is great.

The basic principle is that you get access to high-level CFO skills, at a reasonable cost, instead of having to wait until you get big enough to employ someone full time. A CFO worth their salt can help companies grow so it fixes that chicken and egg problem much earlier in the business lifecycle.

Bookkeeping, BAS, and tax can all be done relatively cheaply these days. The CFO stuff sits on top of that, uses their data. It makes the blended cost cheaper, and you get better results than employing someone mid-level, in-house, to do both bookkeeping and high-level stuff. And they are obviously very different tasks.

If you have to spend money on compliance, try to get some value from it. Bookkeeping and tax definitely fall into that category. We can turn the data they collect into useful stuff, that’s what we do.

We often recommend that businesses up to about 10M turnover use a specialist bookkeeping/tax firm. For a fixed a monthly charge they do the bookkeeping and payroll, pay the bills, do the BAS and the annual tax. And they do all this for a lot less than it costs to employ someone and have them sitting at a desk in your office. And of course, an employee is not so great when they are on leave or unwell. Plus all the trouble of finding, training, and keeping the right person. It’s just not nessesary anymore.

This is a relatively new thing made possible by cloud software. There are some great firms we have worked with that provide very good service. I’m more than happy to recommend someone for you if you want to contact me.

Sure you need to have someone in your business to do the billing but we see billing as an operational process anyway. You need to own it.

We really enjoy working with businesses that have outsourced accounts. We know we can better rely on the data. We provide specialist operational reporting services that use this data and helps you run your business.

We also meet with you once a month to go through the results.

The combined cost is far less than you would pay for an in-house accounts person and a bolshy once-a-year tax accountant.

Get in touch if you want to talk about our onboarding process.

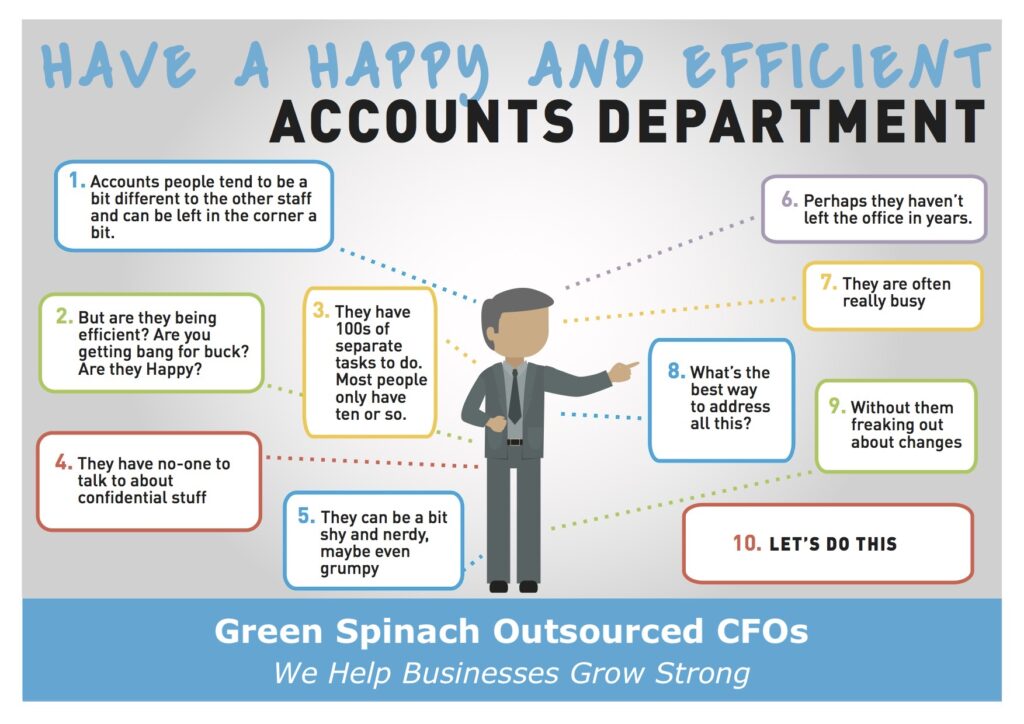

Accounts staff will often tell you they’re too busy when you ask them to do something new. I get it that it can be annoying sometimes, it seems like they are always resistant to new ideas. They tend not to be dramatic people, they just put their heads down and work but ask them for something new and you’ll often get a sigh and a “Fine, I’ll do it”.

Accounts people are different from frontline roles; there are hundreds of different tasks to do when frontline staff usually only have a dozen of so. Accounts work requires a certain personality type to be able to cope with these multiple responsibilities. Different, to say a sales person, so they often get a bit marginalised. And accounts people tend to stay in roles for longer periods of time and often get professionally isolated. Isolation is especially acute because they deal with confidential data and can’t openly discuss a lot of issues the way other employees can.So how do you know if they need more resources, or that they might need to step back from the day-to-day to do some professional development so that the team can be more efficient? Or is it a little of both?

It could also be that the organisation has outgrown them but it’s best to not make that your first assumption.

Accounts staff usually have so much on their plate that it’s hard for them to try anything new, when they are so close to the day-to-day they usually, unfortunately, see it as just more work. It’s hard for them to see the benefits of taking time out to develop and plan, good organisations know this and encourage their professional development.The first steps to a happier and productive work life, for you and your accounts team, is to call time out and get the issues on the table.

Just book a free phone call in “contact us”

So you know, we don’t send bills unless you ask us to do a particular piece of work. We’re not like normal accountants or lawyers, and we don’t charge like them.

Looking forward to the chat.